I sit here this morning firmly ensconced in the Blue Bloggery that is the TharpSter StudyTorium. We received yet another round of thunderstorms last night, shortly after I achieved a REM state and right before Faith, our 9 3/4 toed LabJack started climbing the walls, the kitchen counters, and the makeshift sniper’s nest (still under construction) in great anticipation that the oncoming precipitation was a harbinger of unpleasant things to come.

Come they did.

First it was a sedative, lovingly crammed down her throat in hopes that she would calm down. A follow up squirt or two of a lavender spray around her chest and her bed were added to the mix because the stuff has been known to having calming effects on various Earthlings like house pets of the canine variety and management of the upper type.

Several hours and a few strange, lavender induced dreams later, I sit here at my desk loading the videos from last week’s concert up to the internet, and rummaging through uncompleted pieces of verbal brilliance which may or may not deserve my continued attention.

As I work tirelessly to upload those videos and complete my next masterpiece (most likely the one you’re reading right now), the imagery of the hole in the cream cheese slathered bagel I masticate at this very moment reminds me of a trip I took to the doctor some time back in pursuit of a physical examination.

At one point early on, the doctor asked me where I worked, to which I responded that I work for a mutual fund company.

For what it’s worth, I tend to get nervous telling people what I do for a living. It’s usually pretty difficult to relay to people in a brief series of mono-syllabic utterances a one-size fits all description of what occupies my time during working hours. Case in point, I recently told a newer member of upper management last month that I could be likened to a department henchman for the work that I do.

I don’t have the luxury of telling someone that I’m a doctor who’s about to perform an invasive maneuver with a lubricated rubber glove on the outbound lane of your ailimentry canal.

Upon hearing that I work for a mutual fund company, the doctor gave me that look that I always get in that situation. A pop quiz is coming, because it always does.

“What’s the best fund to get into right now?”

“How are your ETFs?”

“Are precious metals a good investment?”

“How about those crypto-currencies?”

“Got any clean shares?”

All things being equal, there’s a better chance of me posting a picture of Wookies sunbathing with gold bikini clad space princesses than there is of me giving you a response any different from “That’s not quite what I do, as I’m behind the scenes on the operational side of things.”

And so with that look on his face that told me he knew a little about the mutual fund industry, he asked me the pop question de jure. “What are your expense ratios like?”

“Well Doc, we have about 50 different fund portfolios spread out around 16 different share classes. That gives you in the neighborhood of about 850 securities to evaluate for your investment dollar, and you’re asking me about expense ratios?

First of all, I don’t know them, because that’s not what I do.

Second of all, here’s something I’ve learned outside of the world in which I work. If you’re looking to get rich in the world of mutual funds based on optimum expense ratios, you’re basically evaluating the individual trees to determine the value of the forest. The real goal is to find some funds that have good long track records and invest in them consistently over the long term so as to take advantage of time and compound interest.”

The look on his face changed, so I knew I got him. With that, I moved in for the kill with the statement that would halt any more questions on the pop quiz. “So let’s get this rectal exam out of the way so that I can restore my calm demeanor and sunshiny attitude. I’m a bundle of nerves right now knowing what you’re about to do to me.”

So I told you that story in order to tell you this one.

Ladies and gentlemen, I come to the internet today in order to dedicate a sufficient quantity of verbal brilliance to the desperate necessity to call bullshit on the bullshit.

Today’s bullshit in which I call bullshit upon presents itself as the student loan debt crisis.

Make no mistake, ladies and gentlemen. I’m not calling bullshit on the crisis itself. I acknowledge it exists and that it’s problematic.

What I’m calling bullshit on is the ignorance of those caught up in the crisis and how they think we got here. In recent months, a game show has appeared on one of the only channels I watch with any regularity. The game show features recently graduated individuals competing for a chance to have all of their student loans paid off.

At the end of the show, the host encourages the viewing audience to contact their representatives in Congress to do something about the crisis.

On a side note, it occurs to me that I now have a prediction to make. At some point in the future, Congress will begin work on trying to solve the student loan debt crisis. Committee hearings will be held and they will feature televised testimony from the experts. I would suggest that a heavy majority of those experts will be in debt themselves, and as such should be (yet won’t be) treated as wholly out of their element.

If this game show that I’m ranting about should pick up traction and become the next big thing whose flash in the pan lasts more than a few years (it won’t), I will predict to you here and now that the host of that particular game show will be invited to testify before the committee about the scourge of student loan debt.

Okay, let’s get back to the rant.

On the rare occasion that I’ve watched more than a few minutes of this show without getting irritated at the lack of understanding around the crisis, I’ve found that for the most part the contestants and host are pretty ticked off about the current situation. They act as if they were the victim of some sort of predatory loan scheme that saddled them with unsustainable debt.

As well they should be.

At the same time, the thorn in their side is from the tree they planted.

Set aside the quoted line from a Metallica song, I’ll put it the same way I put it in my last post.

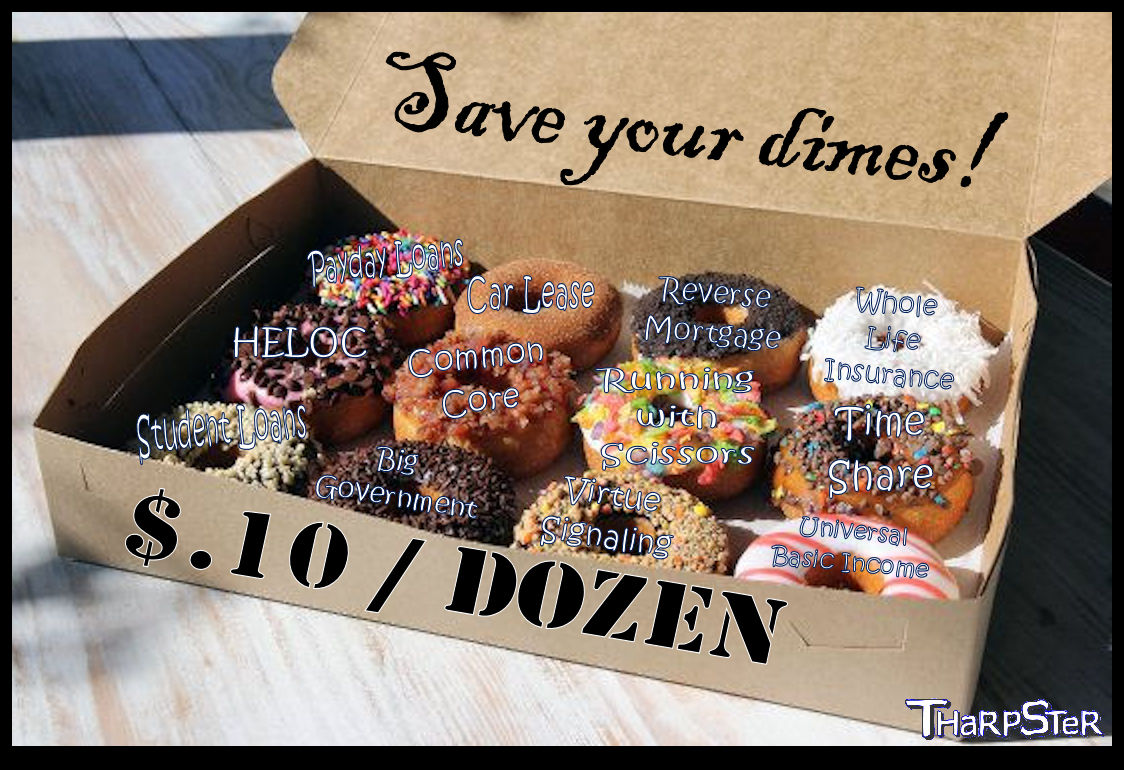

Acts of stupidity like this are available to us for a dime a dozen.

Stop chipping in the damn dimes.

Okay, let’s do a quick test here. Open up another tab in your browser there and initiate a search. Search the following term: “student loan debt chart”

Regardless of what browser and search engine you use, you should come up with a whole bunch of graphs showing a nasty upward trend. You’ll also see where that trend has experienced significant growth in the last decade.

Go figure.

Please make note of the fact that government took steps during that time to insinuate itself into the process of facilitating the debt. As a result, more of our youth have entered into government guaranteed student loan programs in which they’ve been promised pie-in-the-sky terms about how much and for how long they have to pay it back.

At the same time, tuition rates have gone up. It’s as if the consortium of institutions of higher learning (Big Ed) raised their tuition rates in direct proportion to uneducated students borrowing vast sums of other people’s money to pay for the college experience.

Predatory lending, indeed.

There’s a pretty simple solution to all of this.

Stop chipping in the damn dimes.

First of all, get government out of the business of guaranteeing student loans. Don’t tell me we need this process to educate our kids so that we can do great things in this country. Do you know what this country did with our educated people before we started guaranteeing this volume of student debt?

Everything.

We wrote the Constitution and created a successful form of government which keeps monarchs and dictators out of the equation.

We’ve liberated millions.

We’ve gone to the moon.

We’ve seen a million faces and rocked them all.

How many of those efforts were successful because those who participated in those activities had the “benefit” of going to college while amassing government guaranteed student loan debt?

Now I will acknowledge the fact right here and now that since we’re barely 10 years into these shenanigans that we’ve haven’t had enough time to find out if the beneficiaries of this program will contribute to the greatness of this country. For all tents and porpoises, I only have two things to point to which suggest that we have 10 pounds of crap in a 5 pound bag.

Item 1 – An innocuous game show on an innocuous television network in which recent graduates appear to characterize themselves as the victims of predatory lending practices.

Item 2 – The fact that the student loan debt crisis is proving out to be everything it was predicted to be a decade ago when all of this nonsense was being introduced.

Now far be it from me to just sit here bitching about a problem without offering up a solution. So put your thinking caps on, boys and girls. How do we stop the hemorrhage and still educate our kids?

Why not explore what’s worked before?

As I said before, get the government out of the education business altogether. They don’t need to be involved with students applying for financial aid for higher learning anymore. The first thing to do is to remove them from the equation.

The next thing to do is to expand the privatization of financing education. Incentivize the private sector to expand its grant and tuition programs. Incentivize the private sector to expand its tuition reimbursement programs. The GI Bill provides education benefits to those who have served our country in the armed services. Similar programs could be put into place within the private sector.

What about the students though? How do we train them to look for means other than the government when it comes to paying to go to school?

First of all, there are different investment accounts that can be used for covering higher education costs. They can receive post tax, non-deductible contributions, and grow tax free. Start funding those when the kid is born and a properly funded and invested account will more than cover a trip to college without relying on the government to get them there.

Next, we need to change the mindset of our youth to one that it’s not necessary to rely on debt to get through college or life. The popular paradigm today is that debt is a way of life. It doesn’t have to be. If our kids were taught more about financial responsibility during their primary and secondary education, they would learn to shun the premise that student loans of any sort are a good thing. While you’re at it, incorporate a few semesters worth of required classes in high school which focus on applying for grants and scholarships offered up by the private sector. Teach the kids that the education they can get close to home is just as good as the one in some other state, and that it’s a hell of a lot cheaper. Teach the kids that perspective employers rarely take the school they attended into account when considering them for employment.

Finally, fix Big Ed.

Ideally, the way Big Ed is going to get fixed is if we stop chipping in the damn dimes. As long as the government is going to guarantee student loans, Big Ed will charge as much as it can, knowing that more suckers are born every minute. Change the method in which they get their money and they’ll change the way they need to go out and get it.

It’s still Saturday here in the Blue Bloggery that is the TharpSter StudyTorium. By now, I’ve already taken the dog for a walk and she’s now pacing the house because more storms are coming.

I still pucker a little from the unpleasant memory of that encounter in the doctor’s office all those months ago when I was still in my 40’s. Granted such puckering fails in comparison to what’s in store in the years to come when the bullshit upon which I’ve called bullshit goes sideways.